how much is the nys star exemption

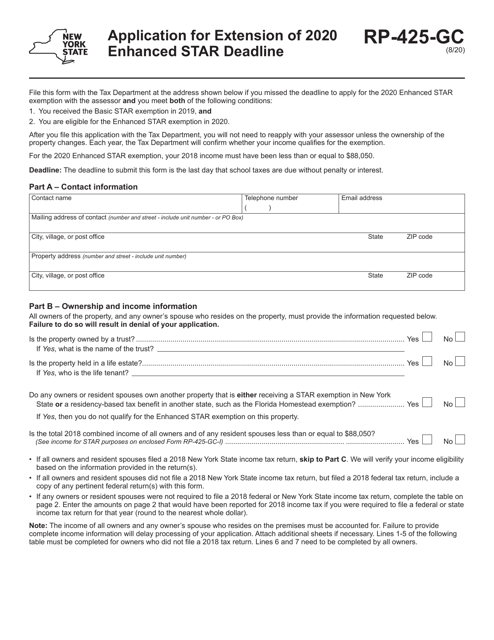

88050 or less for the 2020-2021. The Enhanced STAR exemption provides an increased benefit for the primary residence of a senior citizen age 65 and older who has a qualifying 2020 income of less than.

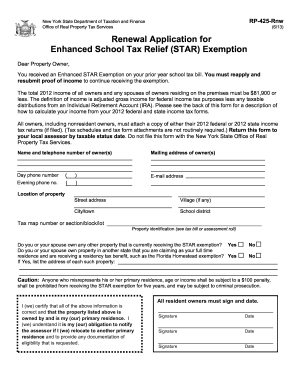

Application For School Tax Relief Star Exemption City Of Albany

Seniors will receive at least a 50000 exemption from the full value of their property.

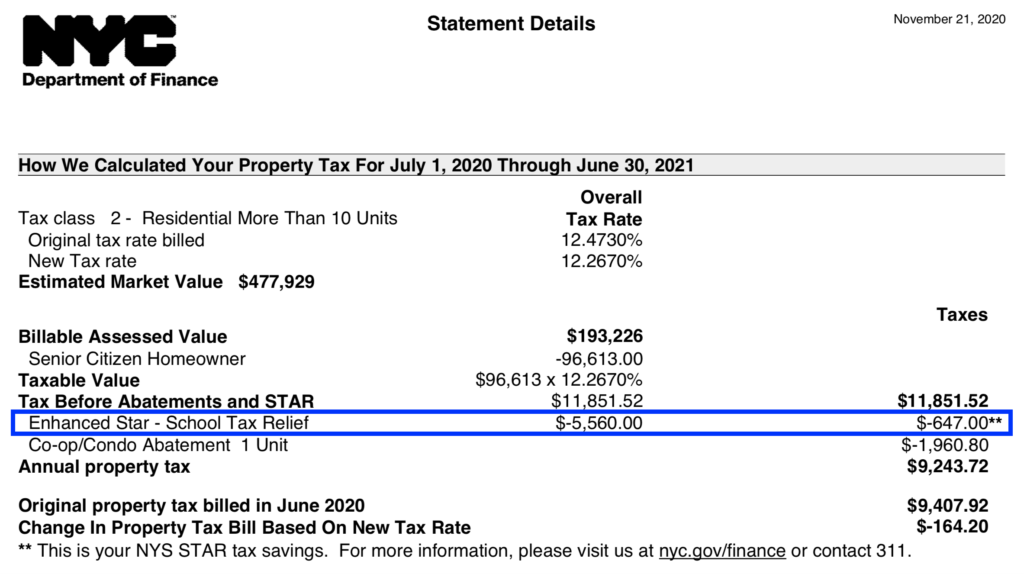

. The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown. Provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes. 74900 13123456 1000 90805.

To qualify the adjusted gross income must be under the State specified limit for the required income tax year 500000 for Basic 86300 for Enhanced and is eligible for a. Exemption forms and applications. The Maximum Enhanced STAR exemption savings on our website is 1000.

5 rows If you are currently receiving STAR or E-STAR as a property tax exemption and you earn. Basic STAR is for homeowners whose total household income is 500000 or less. How much is NYS Enhanced STAR exemption.

The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as much as 2 each year but the value of the STAR exemption savings cannot increase. Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR exemption in the 2021-2022 school year is 70700 rather than 30000 for Basic STAR. The formula below is used to calculate Basic STAR exemptions.

The total amount of school taxes owed prior to the STAR. Call 311 Outside New York City call 212-NEW-YORK Nassau County. It goes to more than 2 million New.

4 rows 250000 or less for the STAR exemption The income limit applies to the combined incomes of only. New York City residents. If youve been receiving the STAR exemption since 2015 you can continue to.

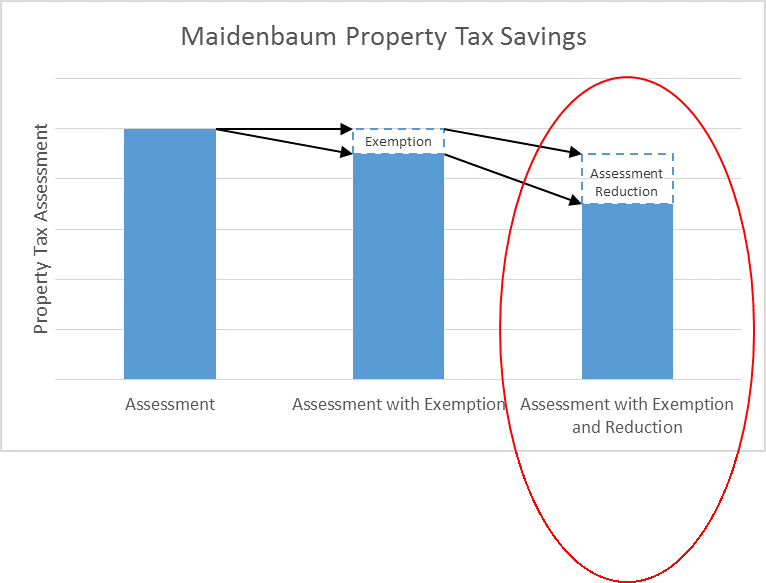

A reduction on your school tax bill. The enhanced STAR exemption will provide an average school property tax reduction of at least. HOW MUCH IS THE STAR exemption in NY.

You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less. The benefit is estimated to be a 293 tax. For those earning between 75000 and 150000 the rebate is 60 of what you receive in STAR.

If youve been receiving the STAR. The exemption applies for schools and city taxes for. If your income is more than 250000 you will no longer receive.

Residents of New York City or Nassau County. The webpages below provide 2021 STAR credit and. If you earn less than 500000 and own your.

STAR helps lower property taxes for eligible homeowners who live in New York State school districts. The Enhanced STAR exemption amount is 74900 and the school tax rate is 12123456 per thousand. It is 35 for households with income between 150000 and 200000 and.

While the maximum annual income eligibility requirement for Basic STAR remains unchanged at 500000 whats changed is that only those whose income is 250000 or less will be able to. The Basic STAR exemptioncredit is available to anyone who owns and lives in his or her home and earns less than 500000. The New York School Tax Relief Program also known as STAR provides New York homeowners with partial exemptions for school property taxes.

Basic STAR is for homeowners whose total household income is 500000 or less. Since its inception in the 1990s STAR gave homeowners with annual incomes under 500000 an upfront rebate on their school taxes. How much is NYS Enhanced STAR exemption.

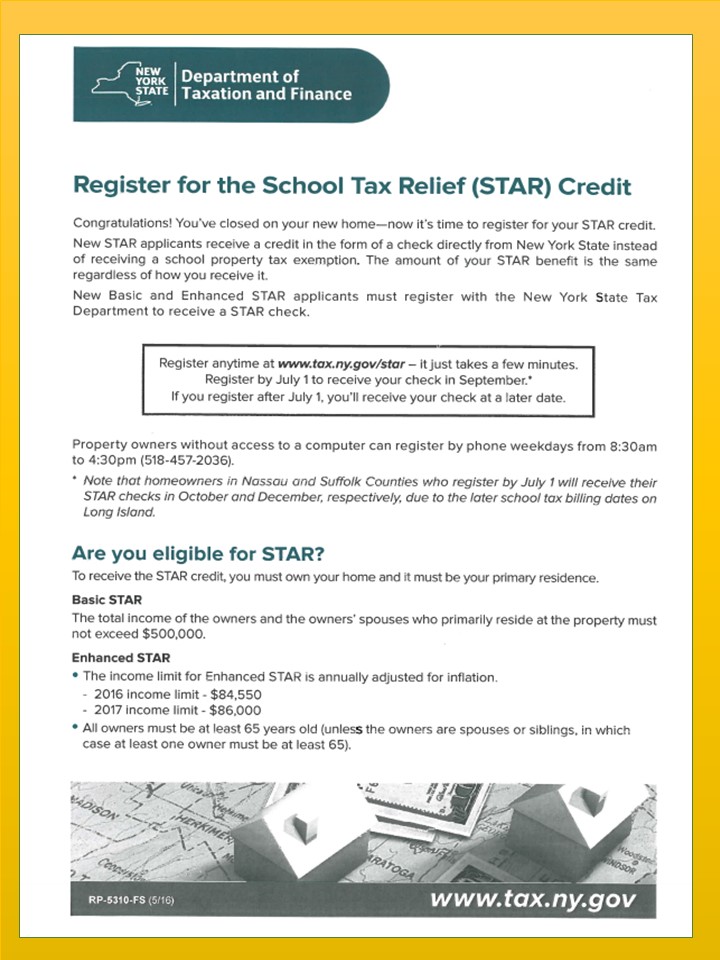

Deadline For Star Approaching Roohan Realty

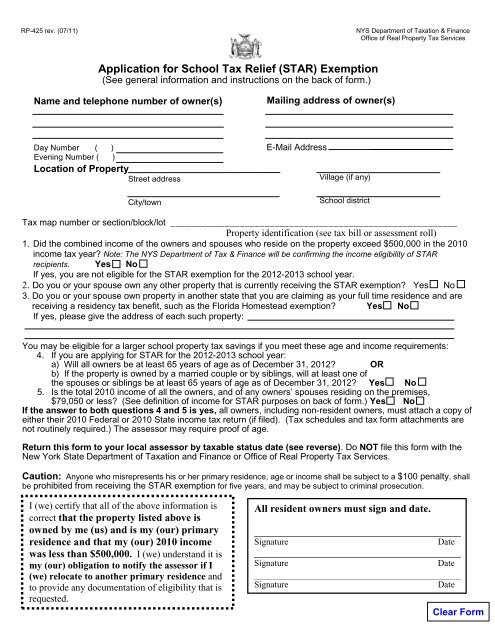

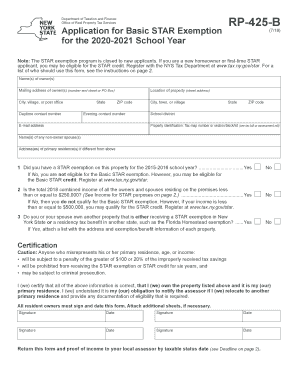

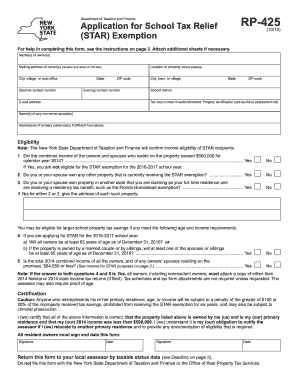

Basic Star Exemption Fill Out And Sign Printable Pdf Template Signnow

Star Program New York Fill Out And Sign Printable Pdf Template Signnow

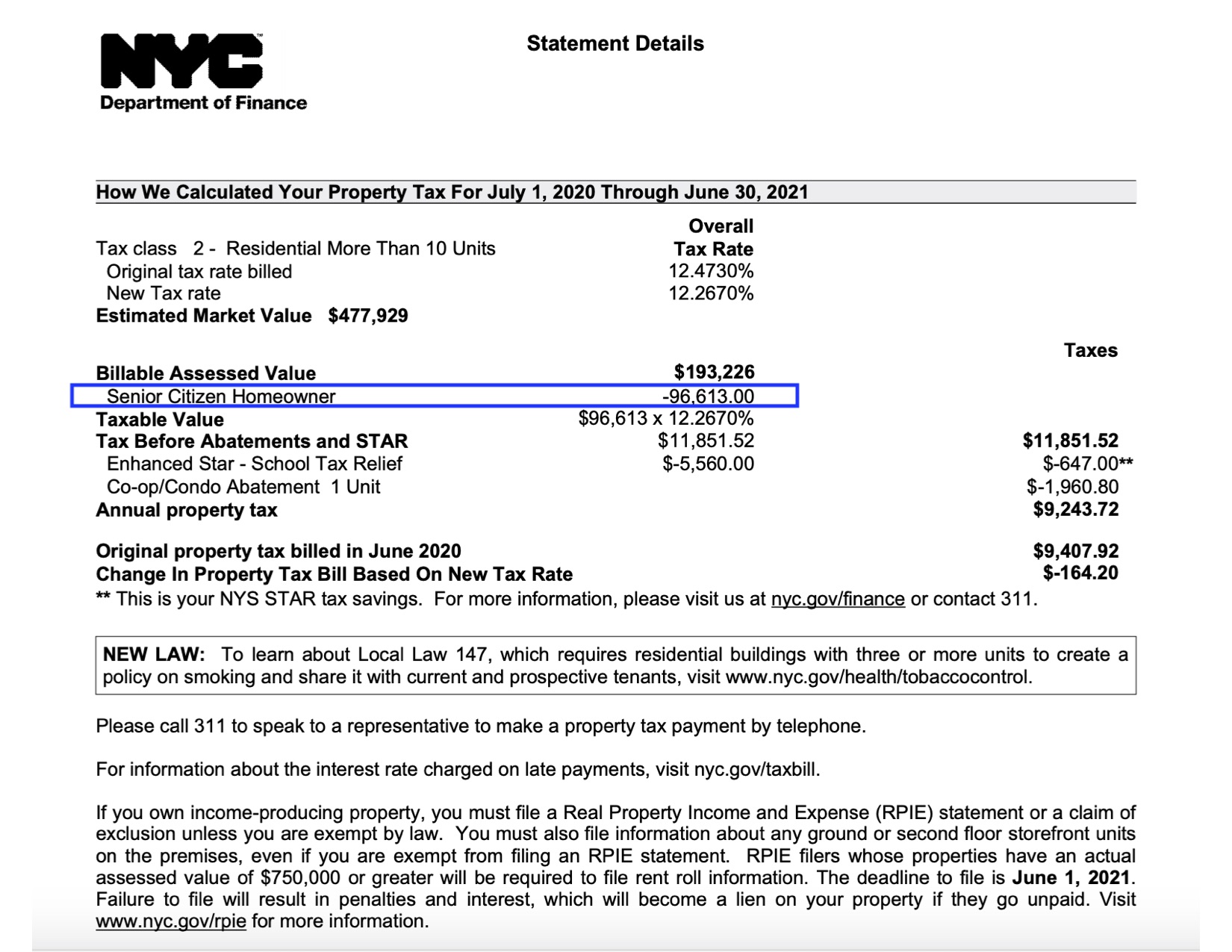

What Is The Nyc Senior Citizen Homeowners Exemption Sche

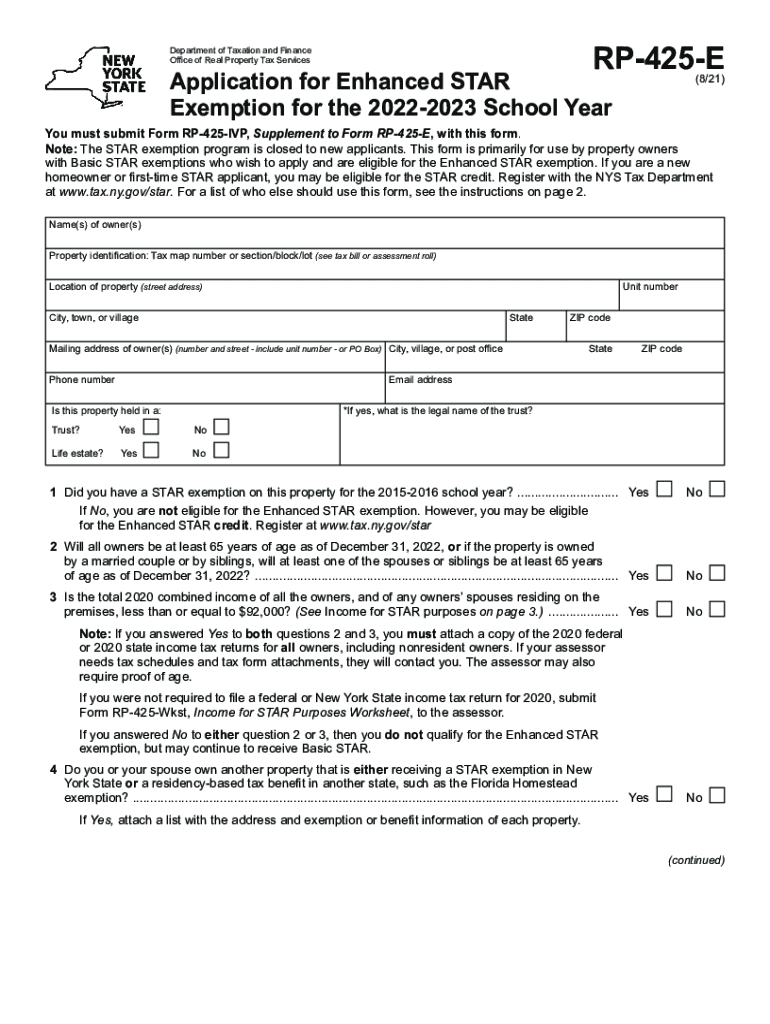

Ny Rp 425 E 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

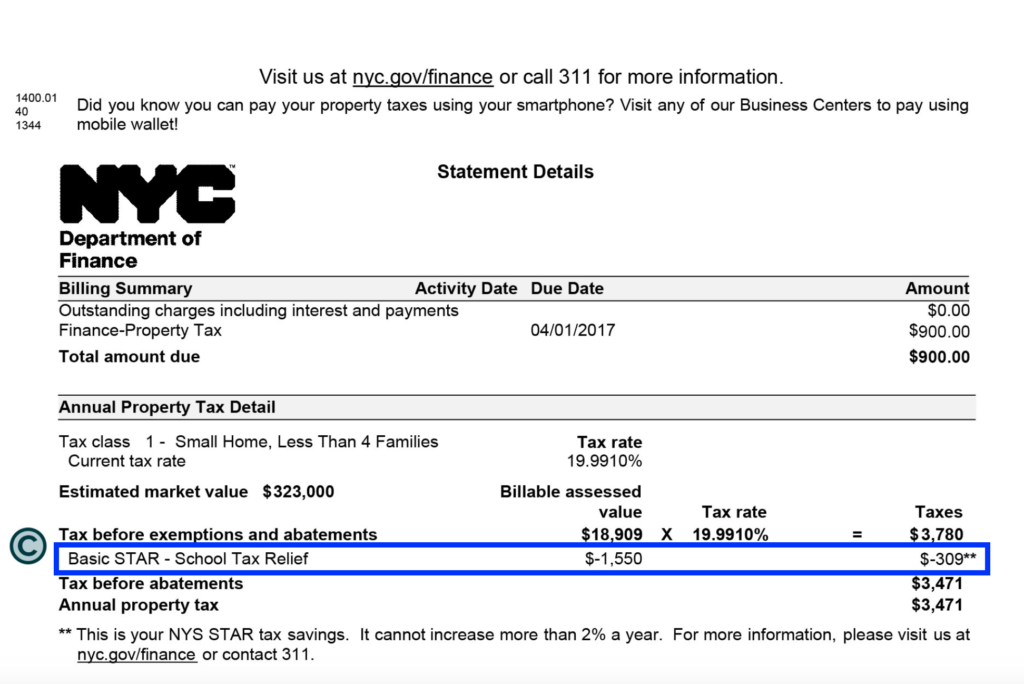

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Star Property Tax Credit Make Sure You Know The New Income Limits Greenbush Financial Group

The School Tax Relief Star Program Faq Ny State Senate

Fillable Online Tax Ny Star Property Tax Exemption Form Fax Email Print Pdffiller

Basic Star Exemption Deadline Approaches

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

All The Nassau County Property Tax Exemptions You Should Know About

Form Rp 425 Gc Download Fillable Pdf Or Fill Online Application For Extension Of Enhanced Star Deadline 2020 New York Templateroller

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times